GE bids more than $2 billion to acquire Instrumentarium

Deal could have major impact on mammographyFor the fourth time in two months, GE Medical Systems is making a play for another company. Unlike the first three, however, which sought companies with products complementary to GE's own

Deal could have major impact on mammography

For the fourth time in two months, GE Medical Systems is making a play for another company. Unlike the first three, however, which sought companies with products complementary to GE's own (an IT system for physician offices, molecular imaging technology, and MR coils), this one involves technology that competes directly with GE's imaging portfolio.

In the cross hairs is Instrumentarium, a major vendor of mammography equipment and a likely premium-end competitor of GE's full-field digital mammography system, Senographe 2000D.

On Dec. 18, GE and Instrumentarium announced that a definitive agreement had been reached under which GE would pay more than $2 billion cash to acquire all outstanding shares of the Finnish company. The deal, which could close in 2003, is subject to a minimum acceptance by holders of 80% of Instrumentarium's common stock, due diligence, and regulatory approvals in the U.S. and Finland.

In their joint announcement, the two companies emphasized that the acquisition would boost GE's position in the surgical market through Instrumentarium's substantial offerings in anesthesia and critical care. Conversely, Instrumentarium could benefit from GE's IT resources, particularly as they might be leveraged to network the company's digital mammography systems.

"GE is the king of connecting things in hospitals. As much as we have a very good technology for making and capturing mammograms, we need somebody's help in moving these images down the line," said Michael Palazzola, Instrumentarium president of U.S. operations.

The Finnish maker of medical equipment has North American headquarters in Milwaukee, just a few miles from GE Medical's home in Waukesha. If the deal goes through, Instrumentarium's home base in Helsinki will become European headquarters for GE's IT business, according to a prepared statement by GE.

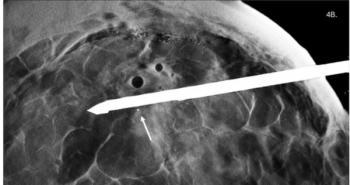

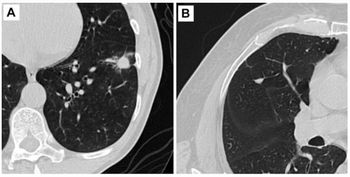

Of most importance to the radiology community is the major impact the proposed merger could have on mammography. Instrumentarium's Diamond DX full-field digital mammography system is in clinical studies to gather data for an anticipated marketing application to the FDA. Diamond uses a digital detector made of amorphous selenium; GE's Senographe uses an amorphous silicon plate.

Instrumentarium currently markets its Delta 32 stereotactic system and its 3D option TACT (tuned-aperture CT), the film-based Performa and Alpha mammography systems, and a mammography computer-aided detection system supplied by its partner iCAD. Instrumentarium also sells Ziehm mobile C-arms and Soredex dental equipment.

Until the deal is finalized, Instrumentarium will continue to conduct business as usual, Palazzola said. The cash price offered by GE is sure to appeal to holders of Instrumentarium stock, which rocketed to nearly $40 a share on news of the proposal, about double the price of the common stock in early August and nearly $12 more than the day before the announcement. GE will tender an offer of about $41 per share, beginning in January.

GE holds a major portion of the mammography market, and that could be problematic for U.S. regulators, although GE executives foresee no need for divestments for the deal to go through. The company may not be looking so much to boost its market share as gain access to Instrumentarium's resources in mammography, however.

"Diamond was developed later (than Senographe) and it is a much more patient-friendly mammography machine," Palazzola said.

Greg Lucier, president and CEO of GE's Information Technologies, noted in a teleconference Dec. 18 that the company may eventually take the best of both product lines to make an even better mammography system.

Senographe was not developed internally by GE but came with GE's acquisition in 1987 of Thomson-CGR. GE has upgraded the product line since then, but mostly as a platform for its digital flat detector. After 14 years in the limelight, it might be time for Senographe to bow out, especially if Diamond is waiting in the wings.

"If you look at the age of the Senographe, it is due for an upgrade of just about everything," Palazzola said.

Newsletter

Stay at the forefront of radiology with the Diagnostic Imaging newsletter, delivering the latest news, clinical insights, and imaging advancements for today’s radiologists.