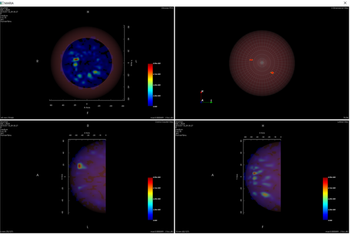

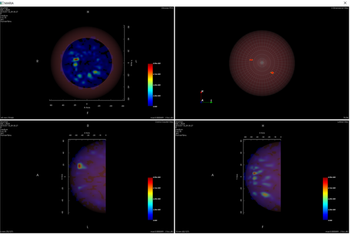

ECR 2018: Electromagnetic microwaves bring much-needed new weaponry to the arsenal of breast and stroke imaging.

ECR 2018: Electromagnetic microwaves bring much-needed new weaponry to the arsenal of breast and stroke imaging.

Radiology's AI players.

Recent FDA review process of inconclusive clinical studies creates a potentially unhealthy decision-making environment for patients needing gadolinium-enhanced MRIs.

The beauty of medical imaging is easy to overlook, but it's still there.

Major Vendors Seek Early-Mover Advantage in Operationalizing Advanced Cloud-Based Imaging Informatics Platforms

Big ticket deals for prospective investors on the RSNA 2016 showfloor.

RSNA 2016 displays more signs pointing towards the blending of diagnostic, interventional, and therapeutic imaging.

The focus of the big three vendors at RSNA 2016.

Latest developments in cardiac PET radiopharmaceuticals from ASNC 2016.

American Society of Nuclear Cardiology 2016 shows the cardiac PET value chain still faces more headwinds than tailwinds.

SIIM16 helped uncover significant baby steps towards outcomes-based purchasing.

SIIM 2016 provides a reality check on the deconstructed deployment model for PACS

SIIM16 shed light on patient-centered radiology, artificial intelligence, and their confluence

ECR 2016 reveals no end in sight to the commoditization trend in CT, but few lights of hope.

HIMSS 2016 uncovers major facelift for the imaging IoT.

HIMSS 2016 helped refine the outlook of the time to market for deep learning in medical imaging.

At RSNA 2015, it was clear that machine learning and radiomics are in radiology’s future.

A ubiquitous theme at RSNA 2015 was the growth of 3D printing, providing an opportunity for radiology to take the lead.

CHICAGO-A key trend from the RSNA 2015 show floor was equipment upgradeability.

Thoughts on Big Iron, managed fleets, and technology partnerships from RSNA 2015.

EMR vendors threaten the cardiology imaging informatics field.

Cardiac MRI procedure volume is on the rise, potentially bidding radiologists and cardiologists against each other.

Radiology and cardiology informatics vendors are less concerned with interoperability in the U.S.

The healthcare strategy of large IT vendors must rely on powerful middleware solutions that they must apply as enabling technologies resolve system inefficiencies.

At the 2011 RSNA Scientific Assembly and Annual Meeting in Chicago last month, the PACS industry seemed to have quit the era of out-of-tune marketing communications cold turkey. The collective marketing message perhaps lacked the energy of years past, but the different voices were certainly more in harmony around PACS 2.0

Teleradiology firms have sought to differentiate themselves through ultra-subspecialization, faster turnaround times, and more efficient workflow IT solutions. They have been doing this so thoroughly - to the point in which the workflow solutions that they had originally developed for their own internal organizations and their respective customer bases now constitute complete product suites that they can sell to the greater medical imaging marketplace, including the PACS replacement market.

If there is just one prediction that has held exactly true since the downturn starting in 2008 in the medical imaging industry, it has to be the one related to the “Big Data” challenge and the fact that imaging providers would continue to face an ever more precarious situation drowning under Big Data.

Traditionally, as a result of the low priority for IT spending, most cross-industry technology transfers have been one-way into healthcare, and very rarely out of healthcare. Now with IT budgets rising, counterexamples of this scenario might become more commonplace.

Published: September 22nd 2014 | Updated:

Published: December 16th 2015 | Updated:

Published: December 23rd 2015 | Updated:

Published: February 3rd 2016 | Updated:

Published: January 12th 2016 | Updated:

Published: March 24th 2016 | Updated: